Summary (TL;DR)

37% uplift in engagement. Suit returns reduced. Customer journeys improved.

In 2019, I led a research project at Next to tackle soaring return rates on men’s suits. By combining analytics, competitor benchmarking, in-person interviews, and remote user testing, I uncovered why customers lacked confidence in sizing and navigation. The outcome? A redesigned suits journey that drove a 37% increase in clicks on the Suit category link within the first week and laid the groundwork for lower return rates and stronger customer confidence.

The Data: Sizing Uncertainty and Missed Opportunities

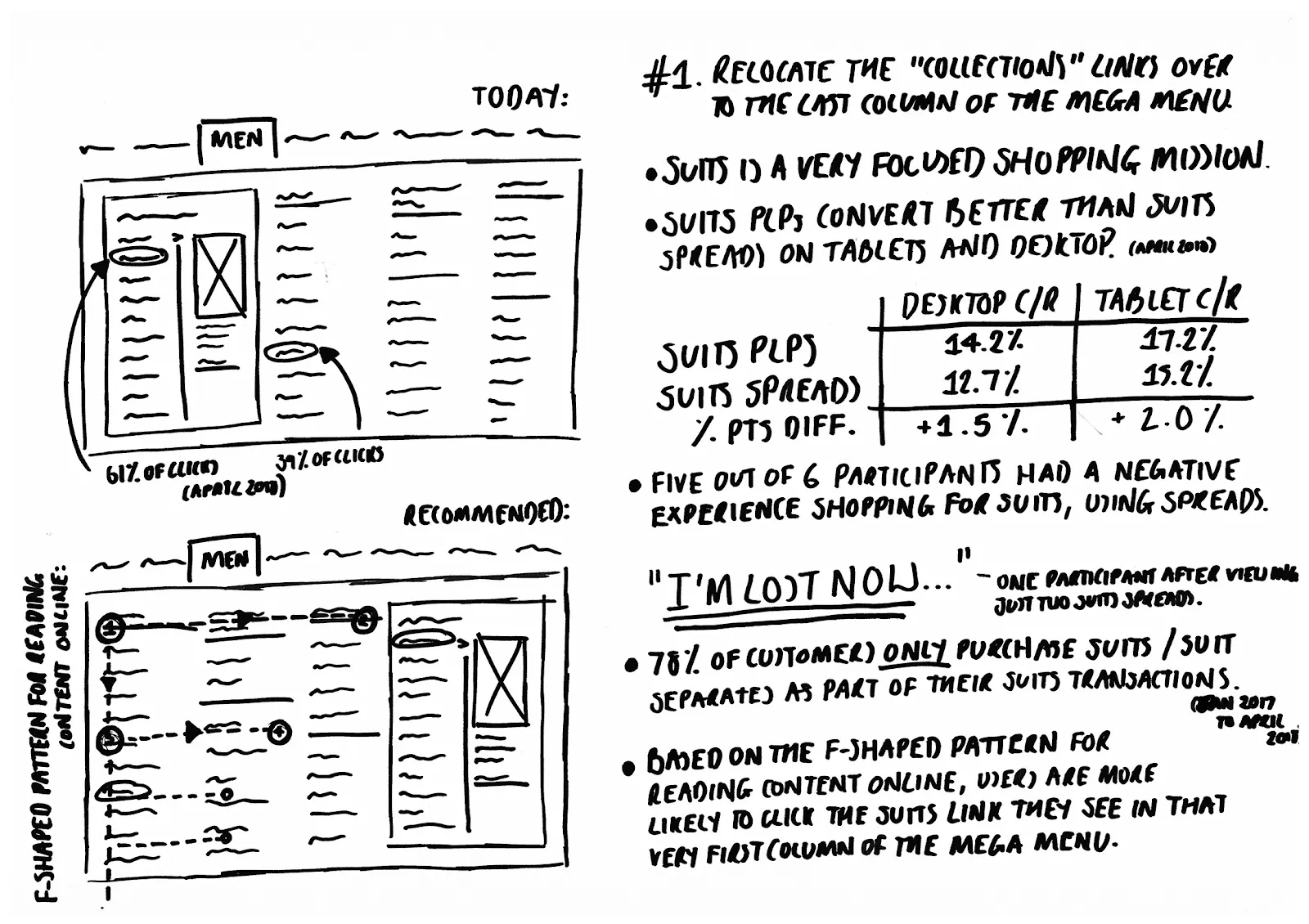

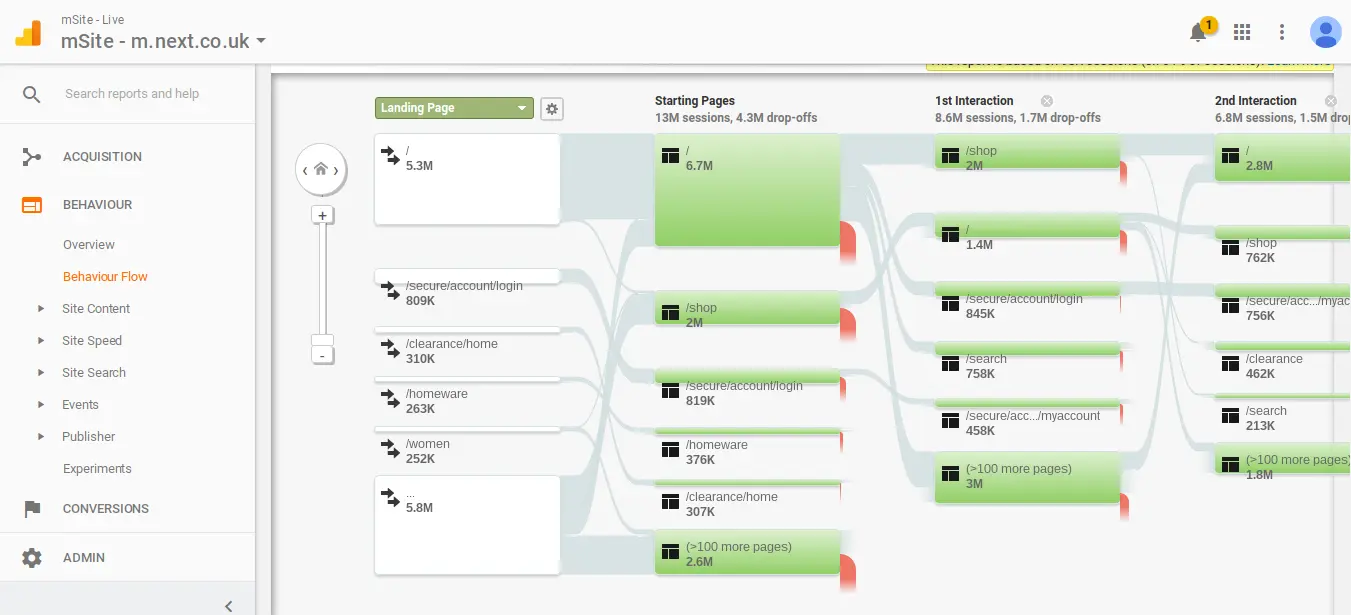

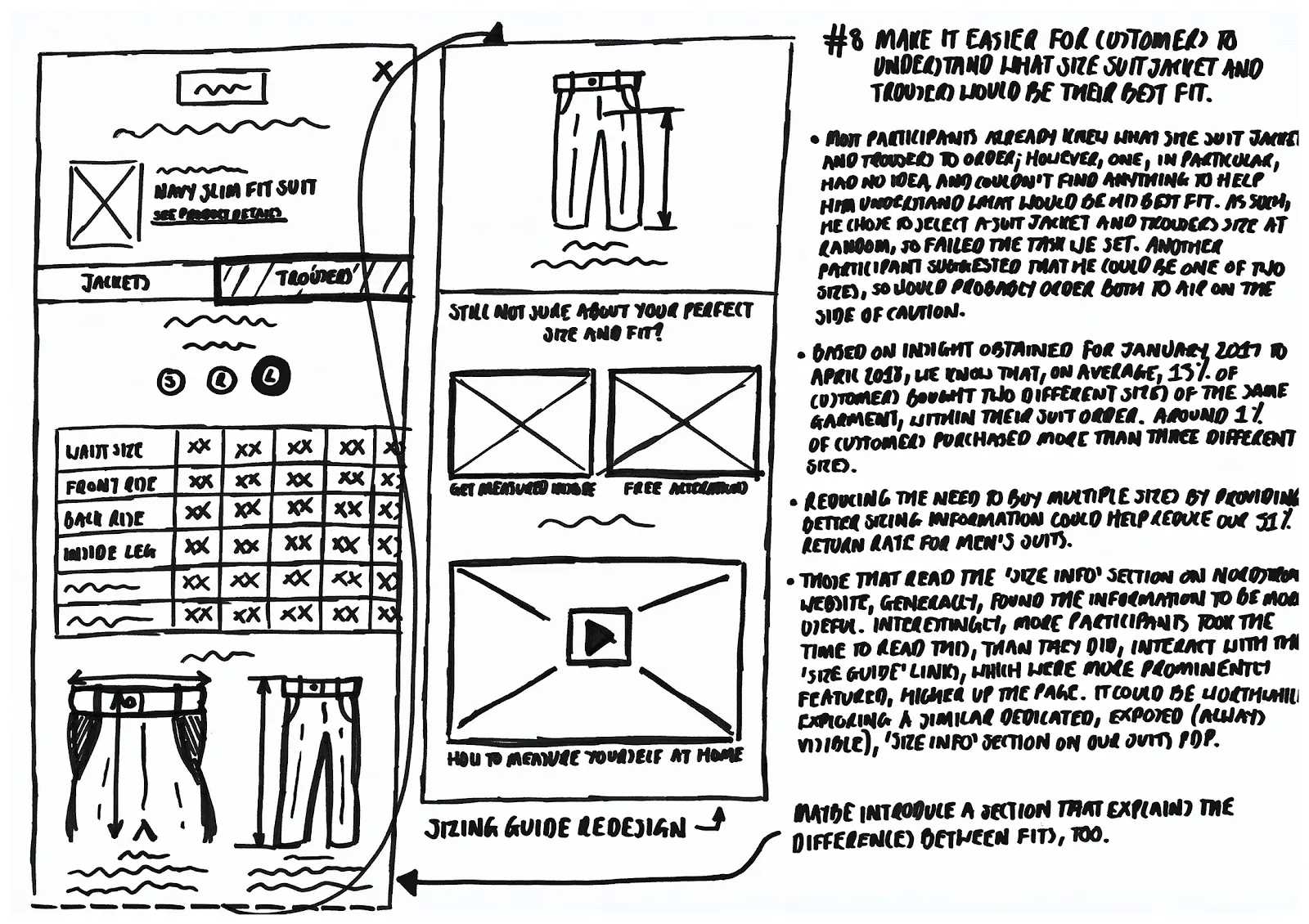

Working with Data Science, I analysed orders and returns alongside Google Analytics data. This analysis revealed a critical ecommerce UX challenge: customers lacked confidence in sizing, which directly drove higher returns.

Key findings included:

- 13% of customers ordered two sizes of the same suit, showing low sizing confidence.

- 1% ordered three or more sizes, signalling major uncertainty.

- Fewer than 1% engaged with the Suits Fit Guide on PDPs.

- 78% of transactions with a suit contained only a suit, missing opportunities for upsell.

Insights are one thing - but how did other retailers tackle this?

Analytics showed low sizing confidence: 13% bought two sizes, 1% three or more, and fewer than 1% used the Fit Guide.

Benchmarking: What Other Retailers Got Right

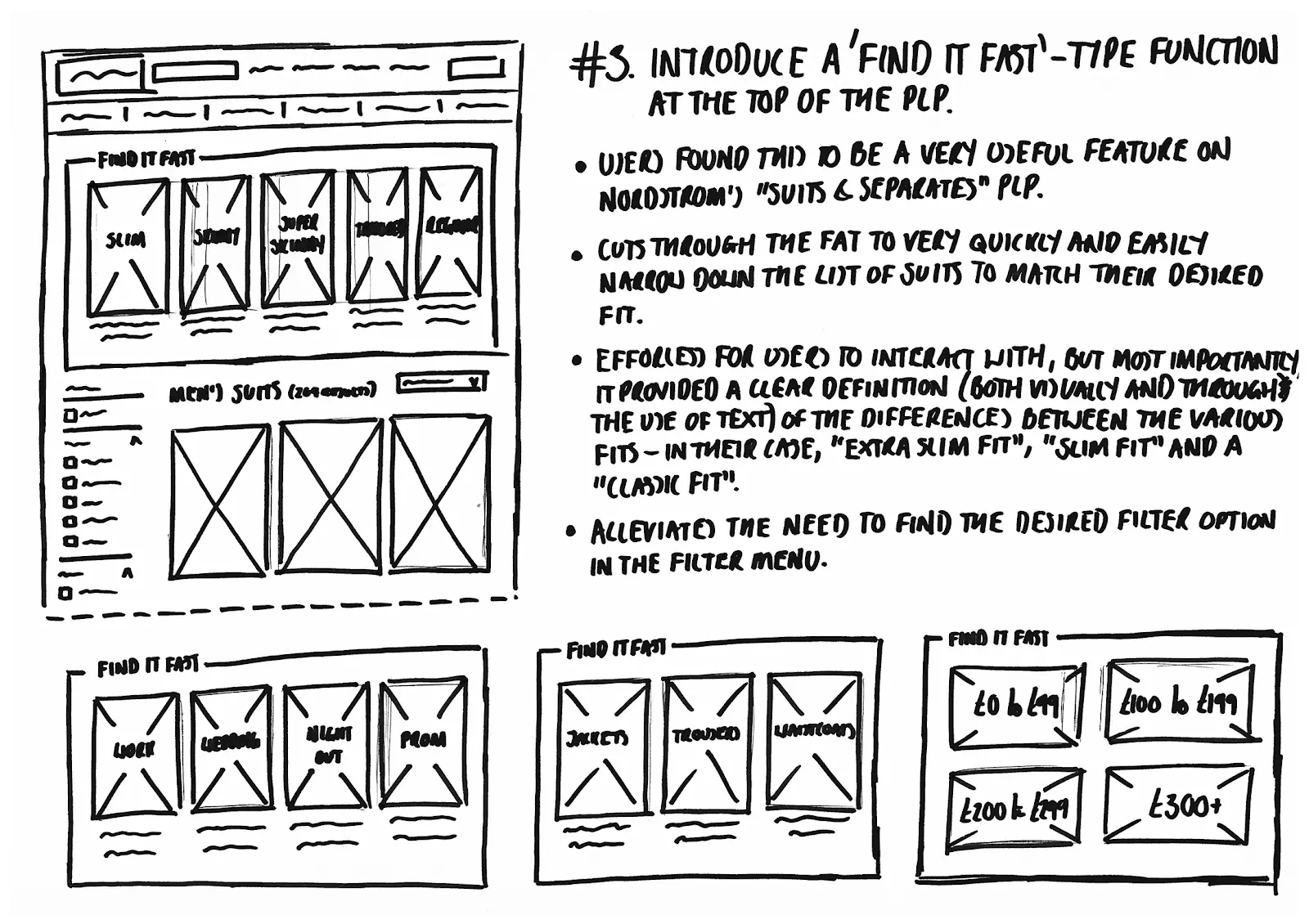

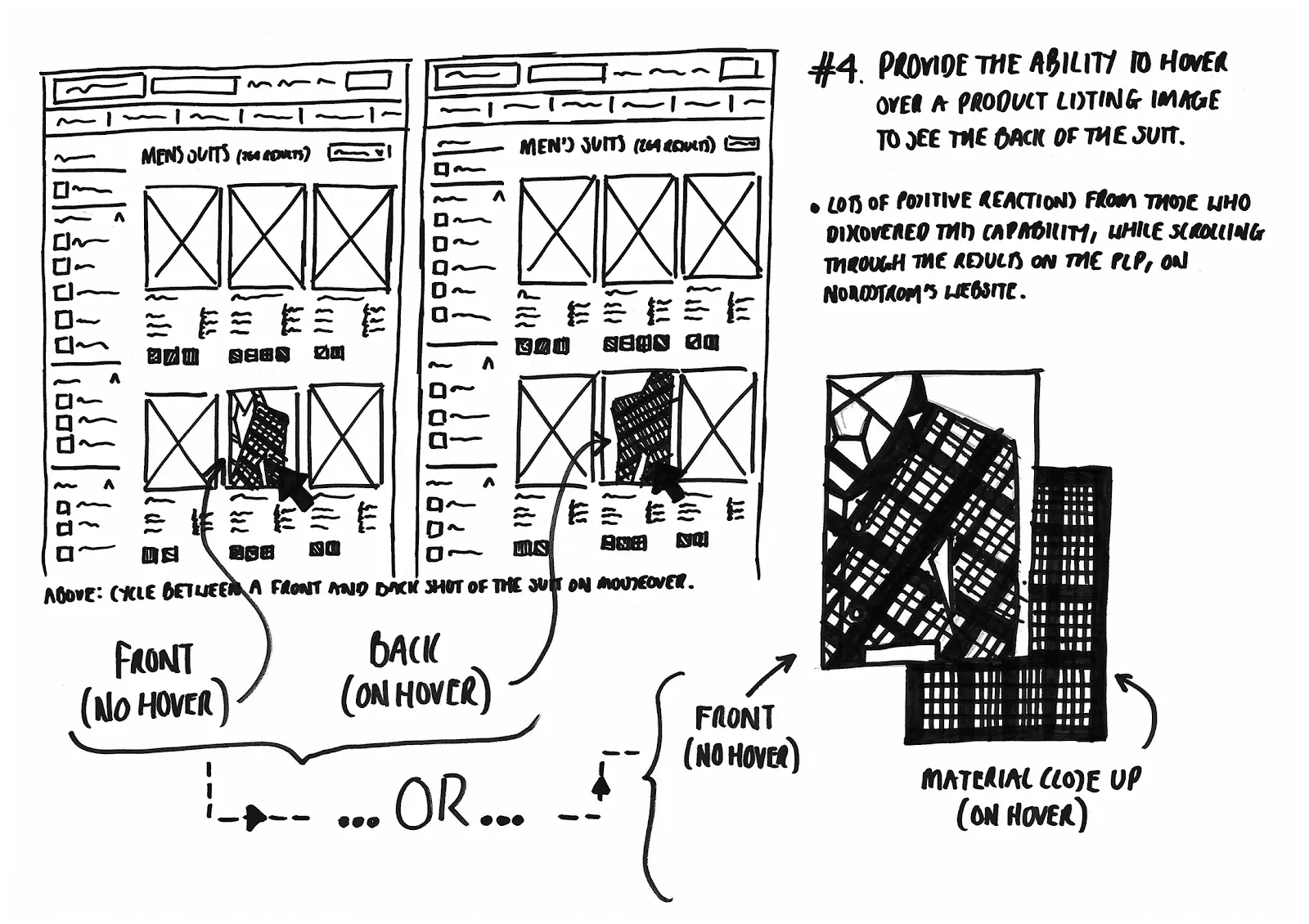

I analysed leading suit retailers and premium fashion brands, from Nordstrom to Combatant Gent, to identify best practices. Standout features included:

- Free home try-on programmes.

- Ability to “Shop by Fit” (e.g. slim, tailored, regular).

- Video guides on measuring for suits.

- Clear breakdowns of suit fit styles.

Still, best practices only go so far. To really understand, I needed to talk to real shoppers.

Listening to Shoppers: In-Person Interviews

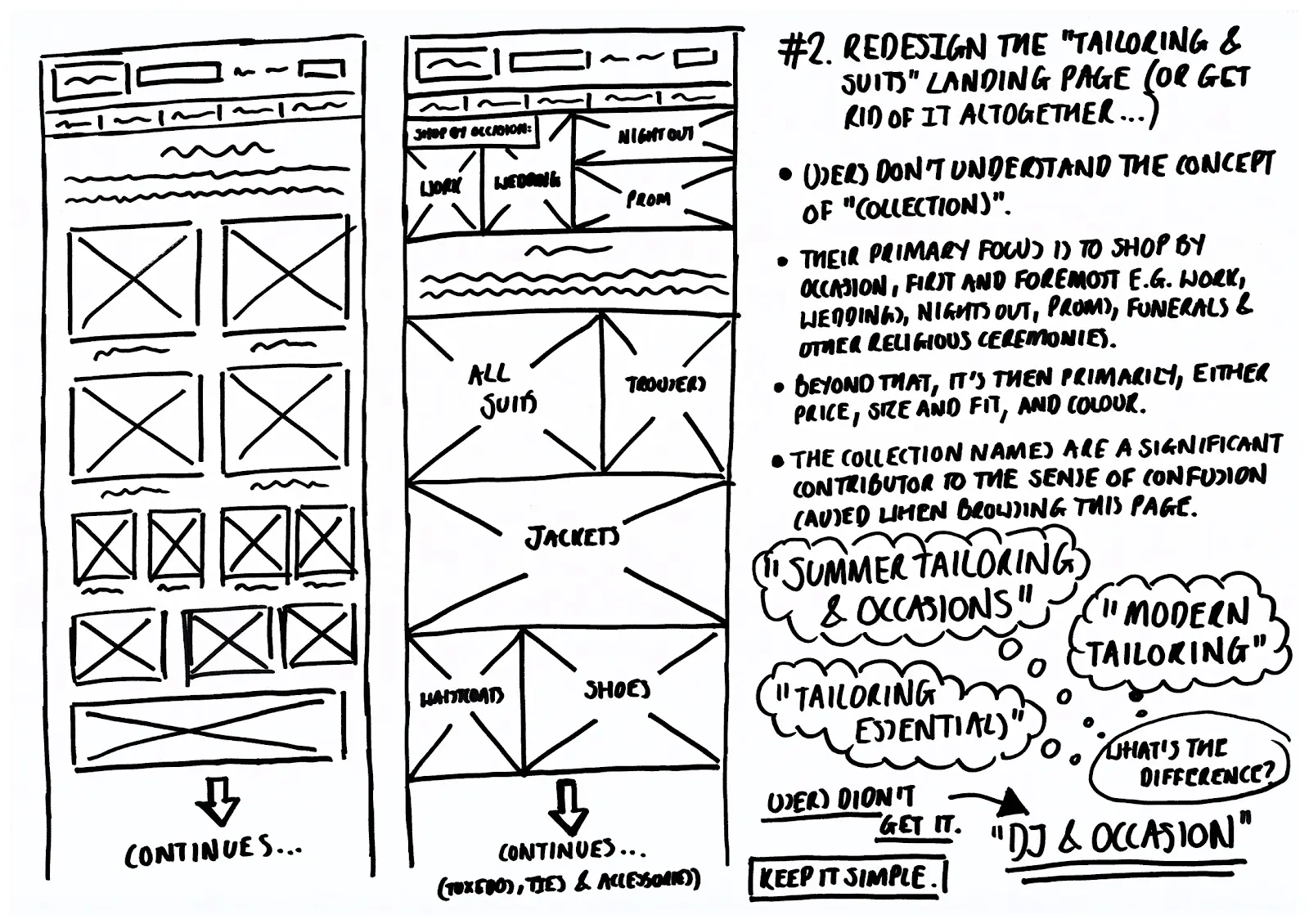

With support from research colleagues, I ran 7 in-depth interviews with active suit shoppers (6 men, 1 woman). These revealed:

- Suit journeys often began in-store, but moved online for stock/size availability.

- Suits were replaced every 1–2 years, trousers more frequently.

- Material, comfort and price were key decision factors.

- Occasions ranged from work to weddings and funerals.

- Reviews were rarely read; shoppers relied on trial and error.

But what happens when you take those same journeys online? Time to test.

User interviews highlighted how the suit journey spans online and in-store, with material, comfort and price as key drivers.

Testing Remotely: Benchmarking Next vs Competitors

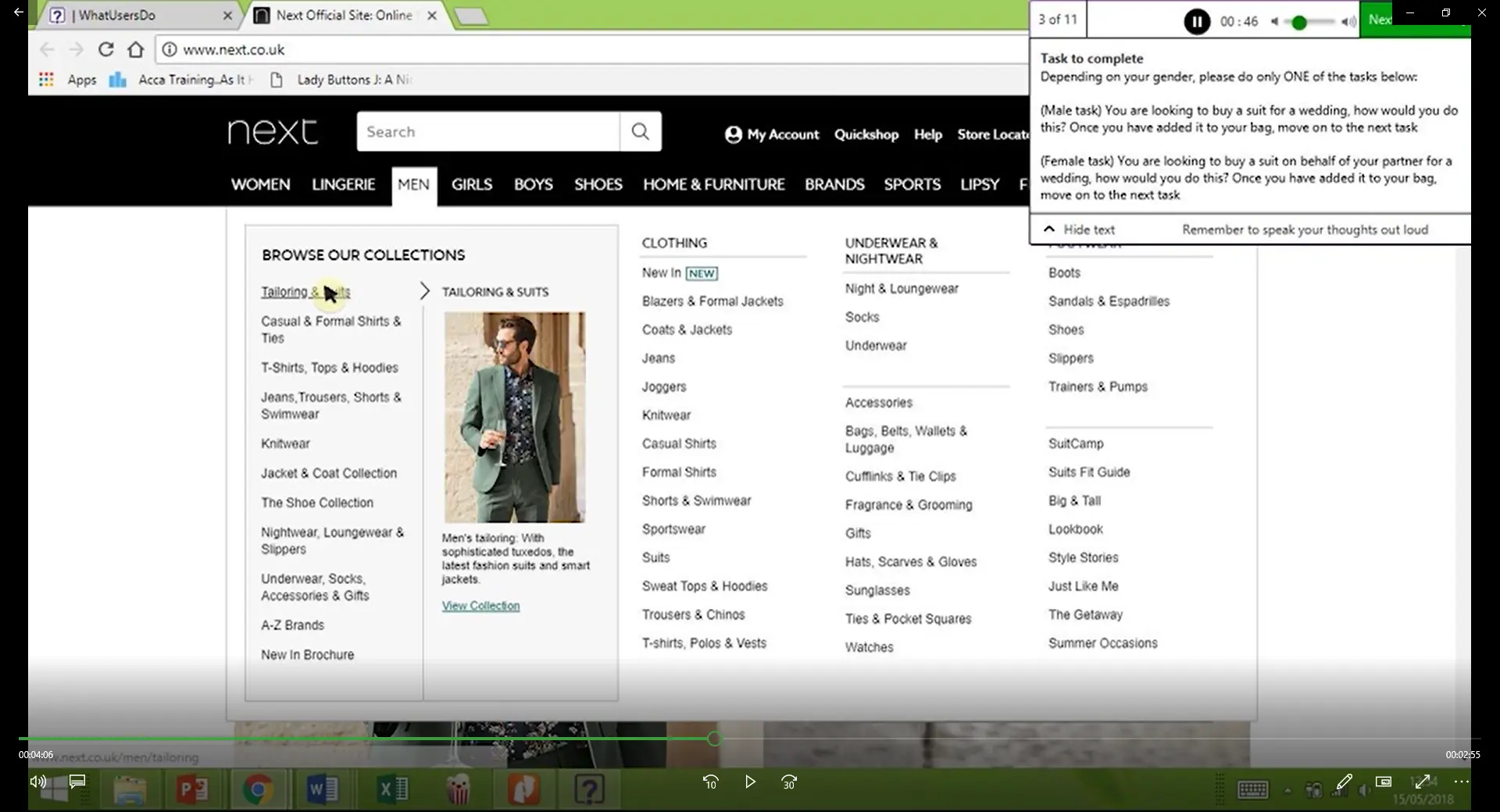

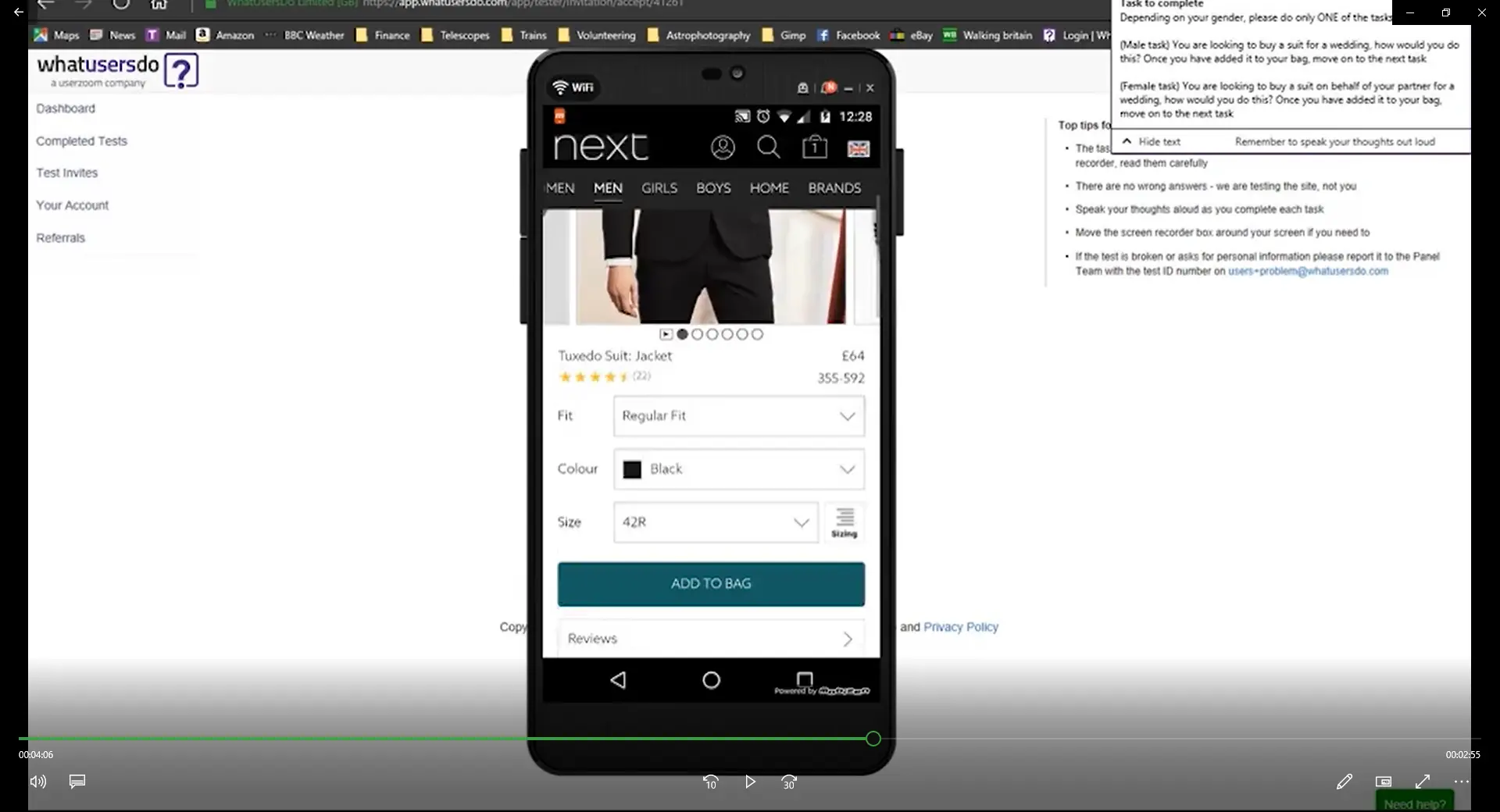

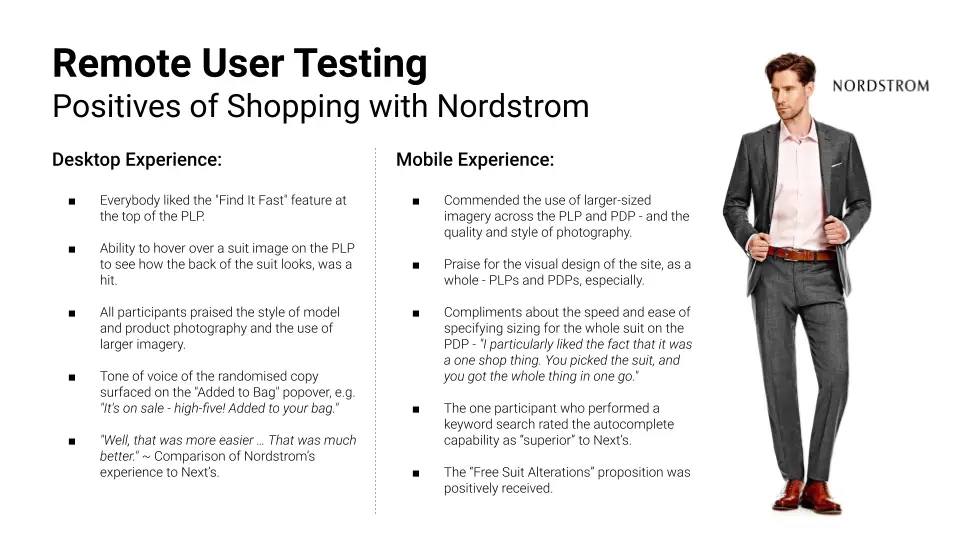

To widen insights, I conducted remote usability tests via WhatUsersDo (later acquired by UserTesting). Participants compared Next with Nordstrom and Combatant Gent across desktop and mobile.

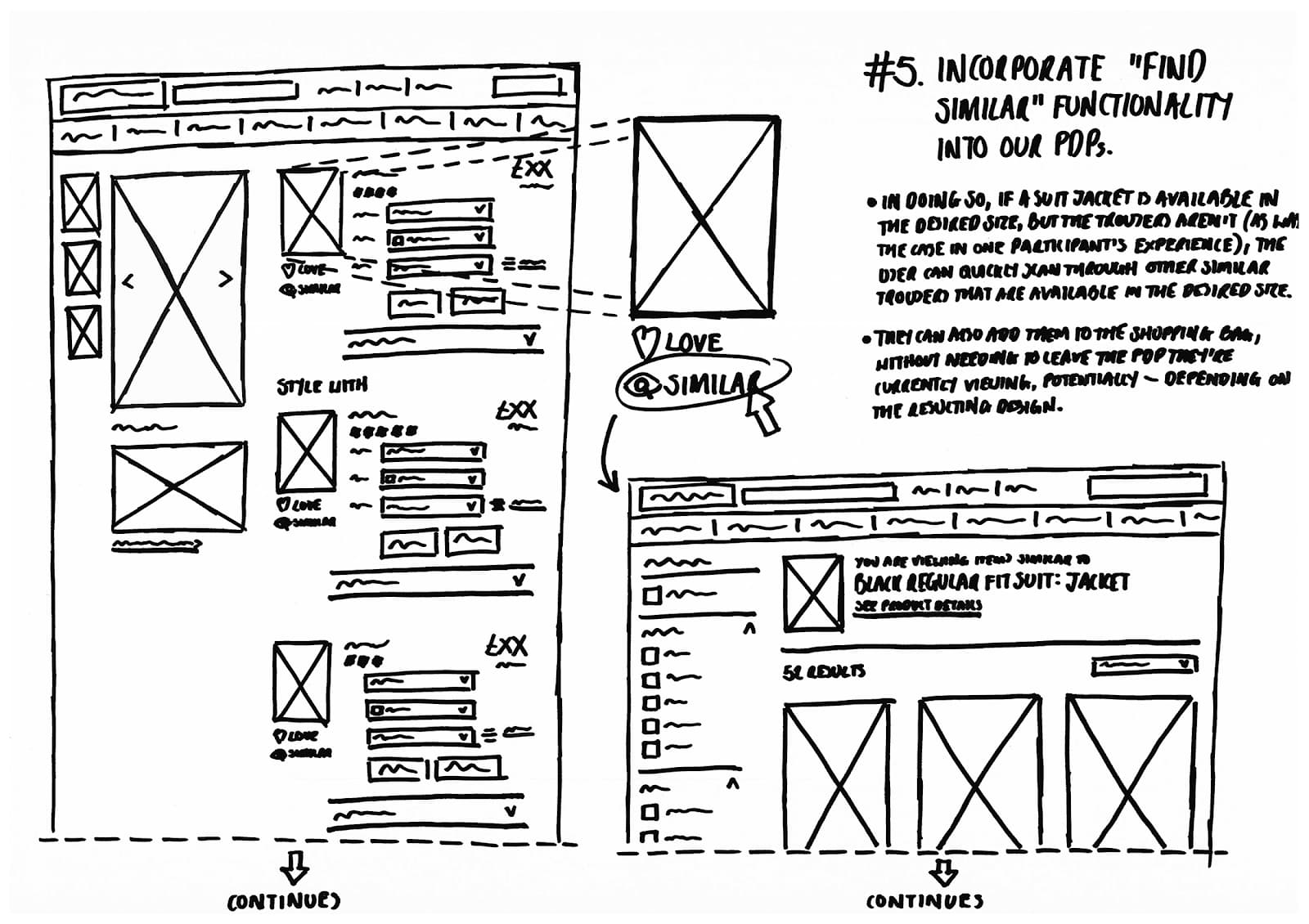

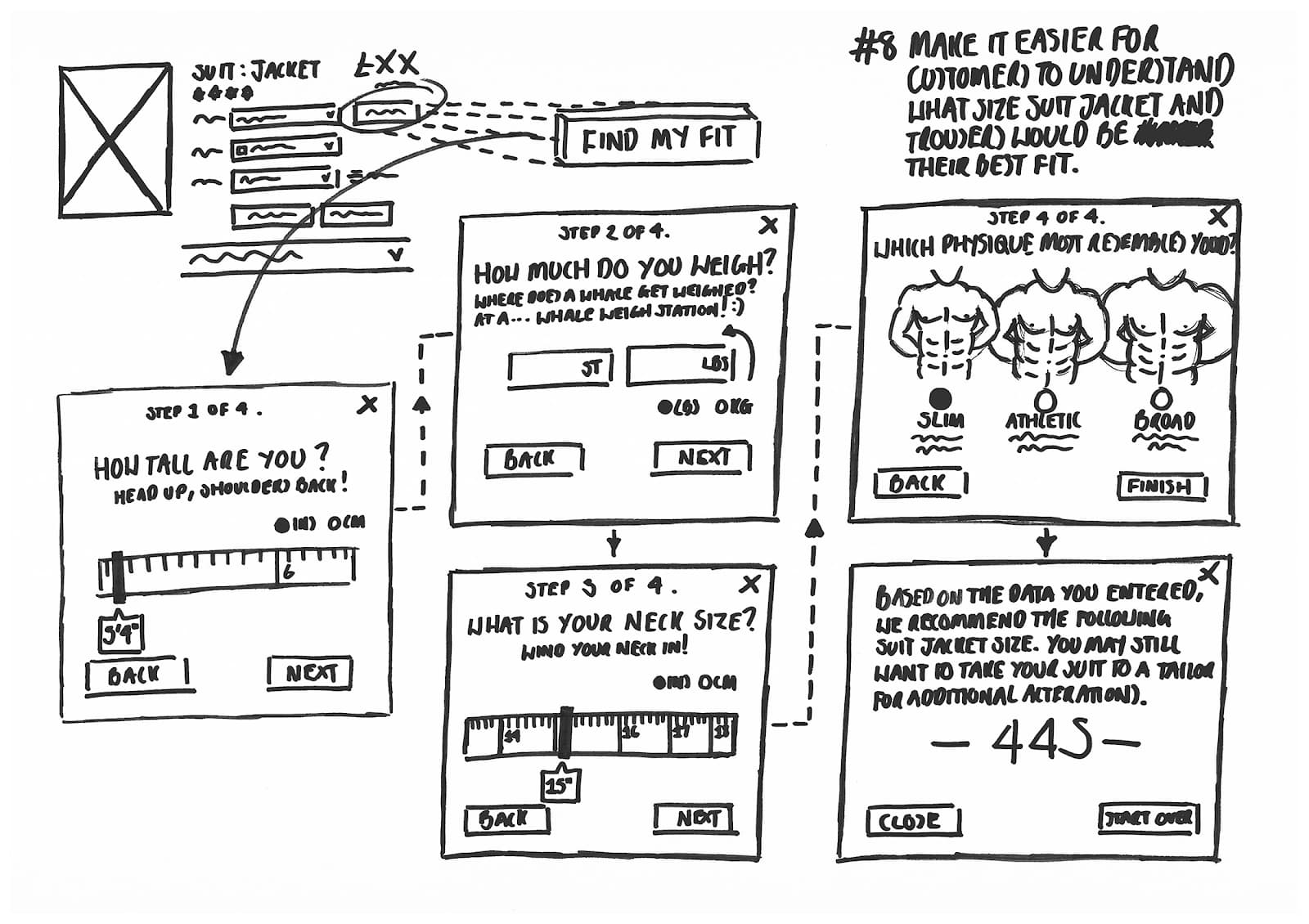

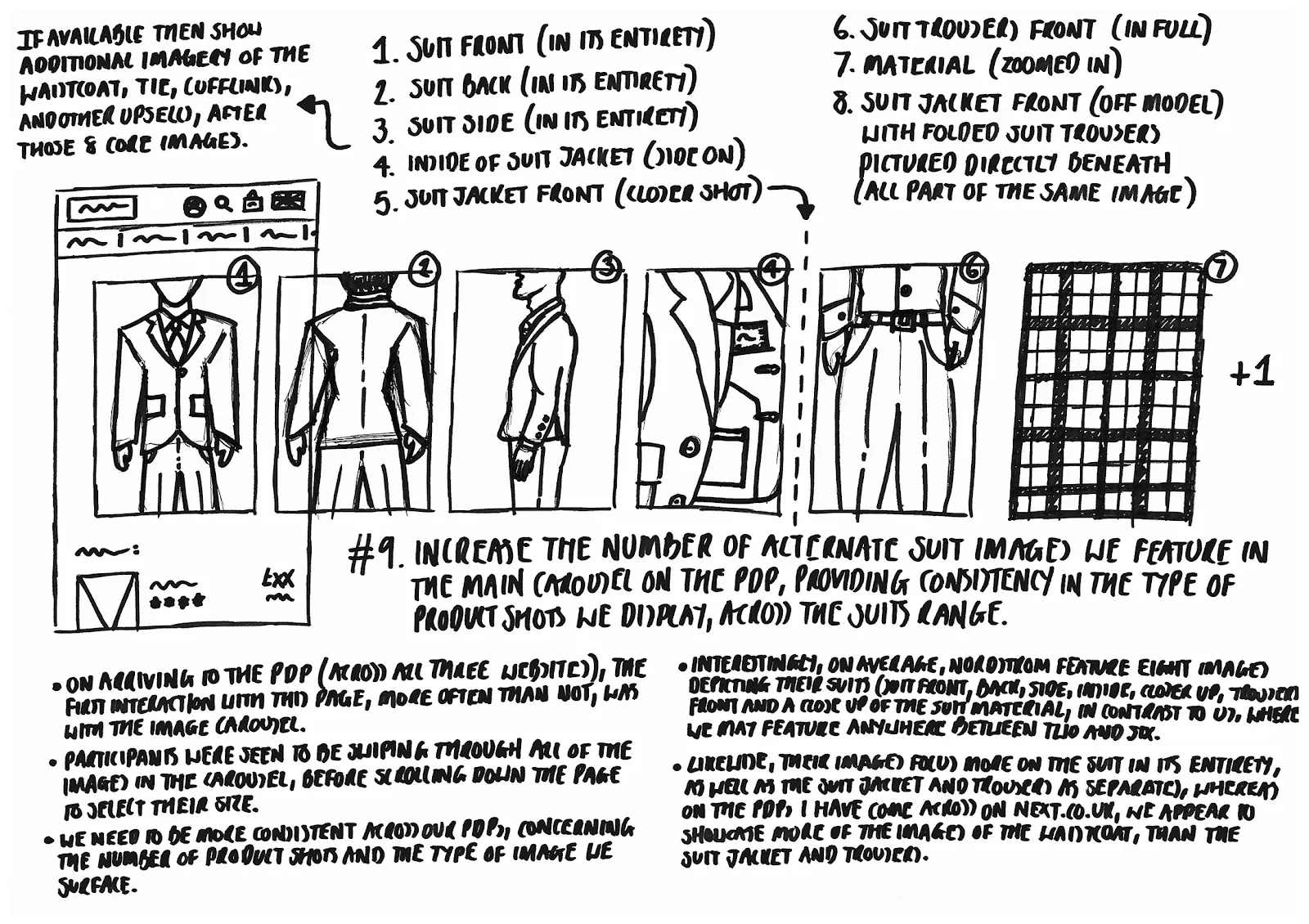

These sessions made clear that the suits journey needed focused conversion optimisation, particularly around fit guidance and navigation.

Findings revealed:

- Competitors provided clearer fit guidance and reassurance.

- Next’s navigation buried suit links too deeply.

- Customers valued “shop by fit” and richer imagery.

With the insights in hand, it was time to design a solution that worked.

Remote usability tests via WhatUsersDo benchmarked Next’s suits journey against Nordstrom and Combatant Gent.

Analysis of remote test sessions revealed pain points in Next’s journey and highlighted clearer fit guidance offered by competitors.

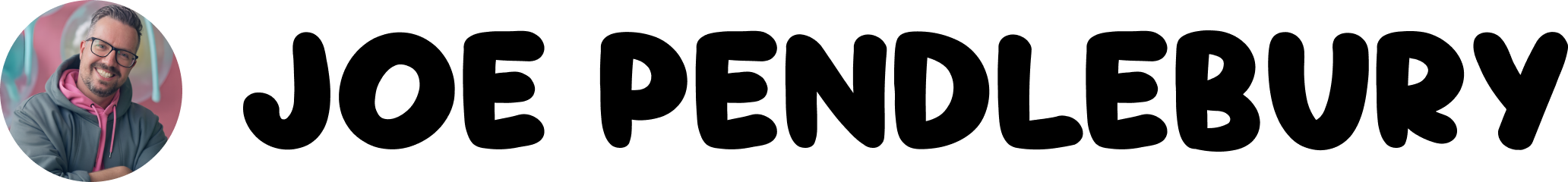

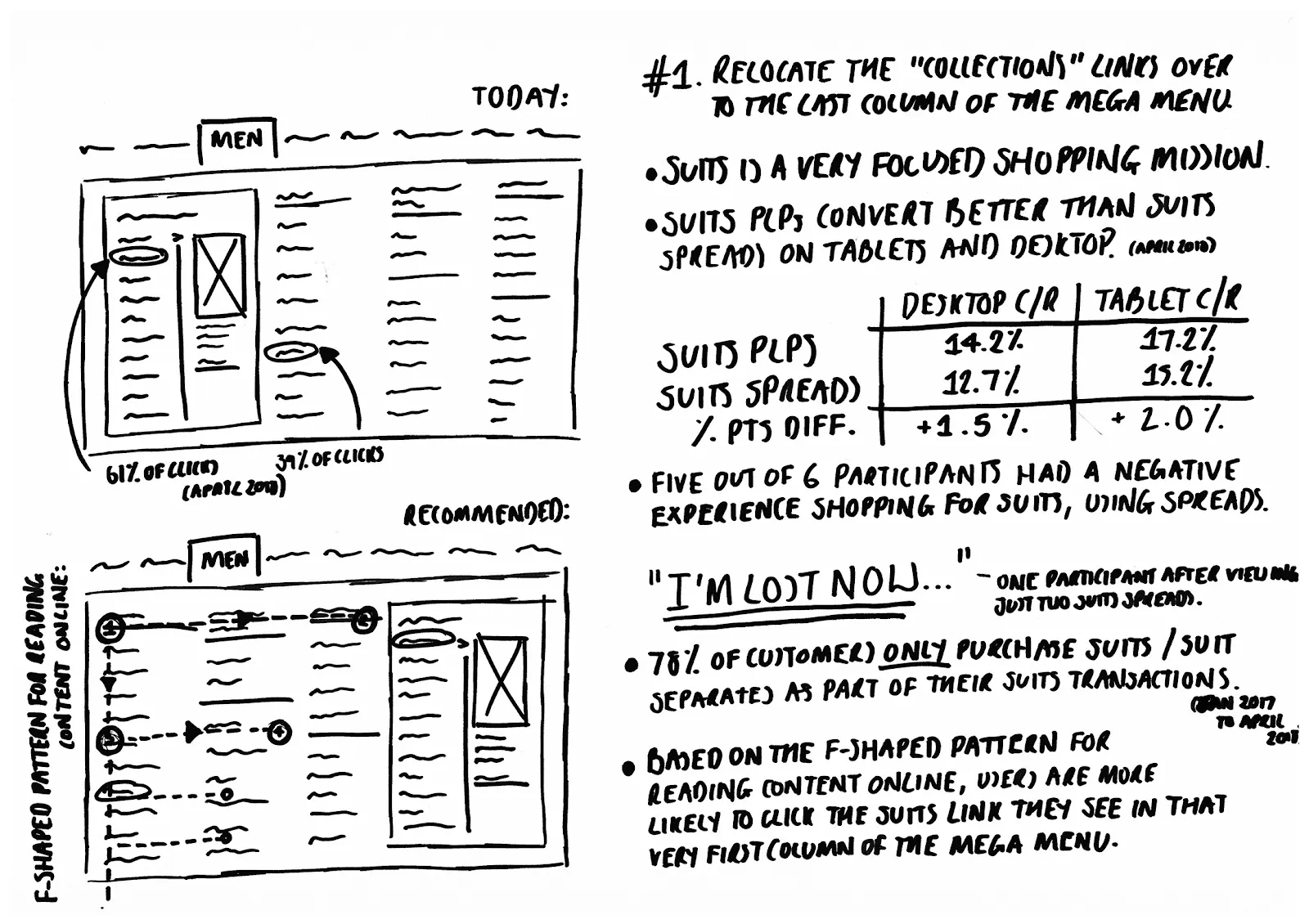

From Insights to Impact: The F-Pattern Navigation Win

Using heatmaps and analytics, I noticed customers scanned in an “F” pattern — horizontal, vertical, then horizontal again. By repositioning the “Suits” link within this scan path, the Category Manager approved a quick implementation.

But would repositioning a single link really move the needle? The results spoke for themselves.

Repositioning the Suits link within the F-pattern scan path led to a 37% uplift in clicks within one week.

The Results: 37% More Engagement, Lower Returns

Within one week of launch:

- Category Clicks: Up 37% on the Suits link.

- Return Rate: Down from 51% toward menswear baseline (36%).

- Customer Confidence: Up through higher interaction with Fit Guide and sizing info.

- Business Impact: Reduced costly returns and improved conversion.

Tailoring Tomorrow: What I’d Do Next

This project proved the value of evidence-led design in ecommerce UX and product growth. By blending analytics, research, and rapid iteration, I improved customer journeys and protected revenue.

If I revisited this project, I’d:

- Diversify research participants further for broader perspectives.

- Pair qualitative findings with more quantitative A/B testing.

- Explore bundling (ties, shoes) to increase AOV and reduce returns.

The lesson? Whether it’s ecommerce, insurance or healthcare, deep user research and smart iteration, fuel measurable product growth. Innovate, don’t imitate.